Counterpointe Sustainable Real Estate A Deep Dive into Green Property Financing

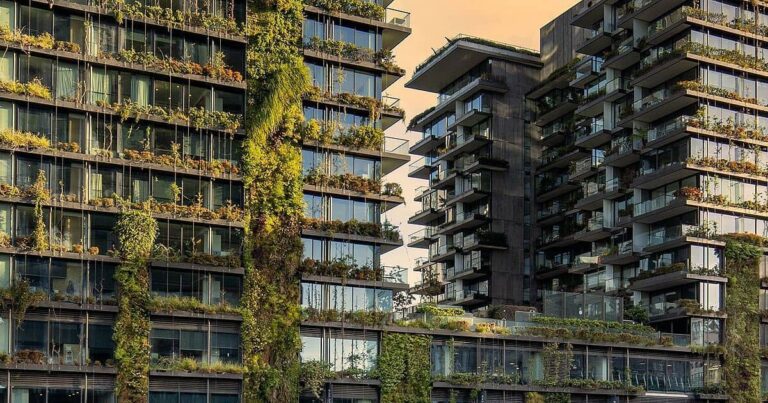

Counterpointe Sustainable Real Estate is a specialized investment and financing platform dedicated to supporting environmentally responsible property development. The company focuses on promoting green buildings, energy efficiency upgrades, renewable energy integration, and sustainable construction practices through innovative financing solutions.

In recent years, the real estate industry has faced pressure to adopt sustainable practices due to climate change, urban growth, and stricter government regulations. Counterpointe addresses these challenges by financing projects that prioritize long-term sustainability while generating strong returns for investors. This approach has made them a key player in the U.S. sustainable real estate landscape.

What Makes Counterpointe Sustainable Real Estate Unique

Counterpointe Sustainable Real Estate stands out because it combines financial innovation with environmental responsibility. The company actively engages in Property Assessed Clean Energy (PACE) financing, which allows property owners to finance energy efficiency and renewable energy improvements through their property taxes.

Unlike traditional loans, PACE financing is tied to the property, not the individual borrower, reducing risk and creating long-term stability. This makes it easier for building owners, developers, and municipalities to embrace sustainable upgrades that might otherwise seem financially daunting.

Additionally, Counterpointe has developed expertise in structuring investment funds that align with ESG (Environmental, Social, and Governance) principles. These funds help institutional investors participate in the growing demand for sustainable real estate projects while supporting global climate goals.

The Role of Technology in Sustainable Real Estate Financing

Technology plays a crucial role in enabling Counterpointe’s mission. By integrating smart building technologies, energy monitoring systems, and renewable energy solutions, the company ensures that financed projects achieve measurable sustainability goals.

For instance, energy efficiency improvements are tracked through building management software that provides real-time data on energy consumption, carbon reduction, and cost savings. This level of transparency not only benefits property owners but also reassures investors that their capital is being deployed responsibly.

Another example of technology’s role is in renewable energy adoption. Counterpointe finances the installation of solar panels, battery storage, and energy-efficient HVAC systems. These upgrades directly reduce reliance on fossil fuels, lower operational costs, and boost property value.

Real-World Examples of Counterpointe Sustainable Real Estate Projects

1. Commercial Office Building Energy Retrofit

One notable project financed through Counterpointe involved a commercial office building in California. The property owner sought to reduce rising utility costs and comply with new local sustainability regulations.

Counterpointe provided PACE financing for the installation of solar panels, high-performance windows, and energy-efficient HVAC systems. The results included a 30% reduction in energy costs, increased tenant satisfaction, and a higher property valuation. This project demonstrates how sustainable upgrades can create both environmental and economic benefits.

2. Multifamily Residential Housing Upgrade

Another project involved a multifamily residential complex where residents faced high energy bills and outdated infrastructure. Counterpointe financing supported upgrades such as LED lighting, water-saving fixtures, and insulation improvements.

The impact was twofold: residents experienced lower utility expenses while the property owner benefited from reduced maintenance costs and compliance with state green building standards. This project showcases how sustainable financing directly improves community living conditions.

3. Historic Building Preservation with Sustainability

Historic properties often face challenges balancing preservation with modernization. Counterpointe financed upgrades for a historic hotel that needed energy improvements without compromising its architectural integrity.

Through PACE financing, the project installed energy-efficient heating and cooling systems, as well as water conservation technologies. The result was a landmark property that maintained its historical value while significantly reducing its environmental footprint.

4. Renewable Energy Integration for Retail Spaces

In a retail setting, sustainability also plays a key role in customer perception. Counterpointe financed a shopping center that integrated renewable energy through solar installations and EV charging stations.

This not only helped the property reduce operational expenses but also attracted eco-conscious retailers and customers. The financing model showed how sustainability can be a competitive advantage in retail real estate.

Benefits of Counterpointe Sustainable Real Estate Financing

Counterpointe’s approach delivers multiple benefits:

-

Environmental Benefits: By financing clean energy and efficiency projects, the company helps reduce carbon emissions and resource consumption.

-

Financial Benefits: Property owners enjoy long-term savings, higher property values, and access to financing without traditional loan constraints.

-

Community Benefits: Sustainable projects improve living conditions, attract tenants, and support healthier environments.

-

Investor Benefits: Counterpointe’s funds align with ESG mandates, providing institutional investors with opportunities to participate in sustainable development while earning returns.

These combined advantages position Counterpointe as a leader in the movement toward responsible real estate investment.

Use Cases and Practical Applications

Supporting Cities with Climate Goals

Municipalities across the U.S. face pressure to reduce emissions. Counterpointe financing provides local governments and property owners with the means to meet climate mandates without overwhelming public budgets.

Helping Developers Meet Regulatory Standards

Developers must comply with stricter building codes and green building certifications. Counterpointe makes compliance more achievable by financing necessary upgrades while keeping projects financially viable.

Boosting Property Competitiveness

In competitive markets, sustainable buildings stand out. Counterpointe financing enables property owners to add features like solar energy, water conservation, and EV charging stations, which attract eco-conscious tenants and buyers.

Frequently Asked Questions

Q1. What is Counterpointe Sustainable Real Estate’s main focus?

Counterpointe focuses on financing sustainable property upgrades through tools like PACE financing, supporting projects that prioritize energy efficiency, renewable energy, and green building practices.

Q2. How does Counterpointe benefit property owners compared to traditional financing?

Unlike traditional loans, Counterpointe’s financing is tied to the property itself, not the individual owner. This structure lowers financial risk, allows for longer repayment terms, and makes large-scale sustainable improvements more accessible.

Q3. What types of properties can benefit from Counterpointe financing?

A wide range of properties, including commercial buildings, multifamily residences, historic structures, and retail centers, can benefit from financing that supports energy efficiency upgrades, renewable energy adoption, and sustainable retrofits.